NRI Tax Services

Online

Taxxify

·

1.3k

About NRI Tax Services

NRI Tax Services

We specialize in comprehensive tax solutions for Non-Resident Indians, helping navigate complex cross-border taxation requirements. Our services include tax filing for foreign income, property transactions, and compliance with Foreign Asset Disclosure regulations under the Black Money Act.

What Makes Us Different

- Deep expertise in NRI-specific tax implications and TDS requirements

- Guidance on both Indian and international tax compliance

- Remote consultations for global accessibility

Ideal For

NRIs who need assistance with:

- Foreign income and asset reporting

- Property transactions in India

- TDS compliance and tax planning

- Foreign Asset Disclosure requirements

Additional Features

We provide strategic tax planning to optimize benefits while ensuring full compliance with both Indian and international tax regulations.

Meet your Expert

Taxxify

15 connects in last 3 months

My Story

We started Taxxify after seeing how confused most folks got with tax stuff. So many rules, so much stress, and the middle class always stuck in the maze. We didn’t want to just fill forms, we wanted to actually help people understand what’s going on. Our whole thing is: make taxes less scary. We break it down, send reminders, and try to give people some real peace of mind. That’s what drives us, honestly.

My Work

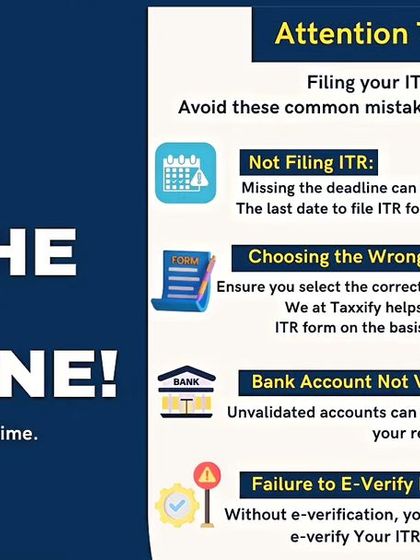

All-in-one tax help - We cover digital tax filing for salaried employees, tax planning, TDS compliance for small businesses, and handling department notices.

Not just data entry - We look out for mistakes, help you claim what’s yours, and keep things simple so you don’t get lost.

Everyone’s welcome - Salaried, business folks, property sellers, or dealing with foreign income - we help anyone, anywhere in India.

No shortcuts, no hiding - We’re upfront: declare everything. Hiding income is a big risk now. Honest, clean filing is the only way.